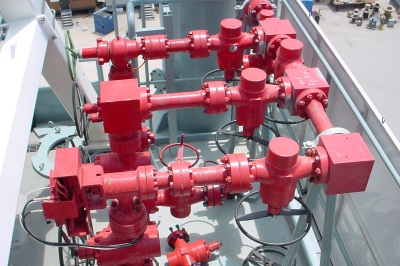

Mergers and acquisitions (M&A) in the oil and gas industry involves buying and selling of a business at a more complex and sophisticated level because of the hydra-headed concerns such as the sale of a whole business including the means of products production and services as well as the infrastructure that goes with it. The oil and gas sector in Nigeria has in recent times witnessed significant M&A transactions amongst indigenous oil companies, to a large extent, driven by the disposal of assets by a number of international oil companies (IOCs).

While it is settled that the most essential element of any merger & acquisition transaction is the agreement of the parties on the price to be paid, however, there remains other fundamental issues which must be settled before a deal can be effectively struck. Also, notwithstanding each deal is unique, there is an acceptable sequence of events that most deals follow, at least to some extent. This paper will attempt a bird’s eye view of the key threshold issues involved.

Due Diligence

As it is expected, purchasers will always want to test-drive the ride before finalizing a price. While the outlines of a deal can sometimes advance quite far before due diligence is complete, at minimum “confirmatory due diligence” will be necessary at some point before money changes hands.

Some of the principal issues as far as due diligence is concerned include:

- Confidentiality or non-disclosure agreements: Potential purchasers are usually required to agree to keep confidential any information disclosed to them. These agreements may include provisions prohibiting the purchaser from buying securities of the seller, and/or provisions preventing the poaching of employees.

- Contracts: This begs the question: Is the seller bound by other contracts which, from a legal or business perspective, require consent before the transaction is concluded? Or which will affect the business negatively, after the conclusion of the sale?

- Title: This covers the question, whether the seller have good ownership to its assets, especially as it concerns real estate and Intellectual Property assets? Are there assets subject to mortgages with lenders or any sort of security arrangement?

- Employees: This in turn inquires whether the key employees can be retained by the buyer. The question centre on the following: Do they have the right to leave and be paid large settlements? Are there challenges (like different work cultures) in combining the purchaser’s work force with the buyer’s?

- Environmental: Given the nature of the assets to be acquired, are there environmental concerns, i.e., pollution, contamination etc.

- Litigation/Potential Liabilities: This examines whether the seller does have outstanding litigation which could lead to liability and in turn affect the business under sale? Are there other potential liabilities for, by way of example, regulatory breaches, warranties, negligence, accounting or financial misstatement or product liability?

Antitrust/regulatory approvals

M & A transactions in the oil and gas sector routinely require approvals, such as:

- Investment and Securities Act 2007 and Securities and Exchange Commission Rules and Regulations, 2013 (“SEC Rules”): Under these laws, a determination is made whether any merger or acquisition is likely to lessen competition. Pre-merger filings and approvals are required for transactions meeting certain size thresholds.

- The Local Content Act, 2010: This law is designed to increase indigenous participation in the oil and gas sector by prescribing a minimum threshold for the use of local services and materials and to promote transfer of technology and skill to Nigerians in the industry.

- Regulatory: Acquisitions in the oil and gas industry requires licensing, permits and approvals for a change in ownership.

Financing

Depending on the nature of the seller’s assets and the buyer’s financial resources, financing can be a very significant element to an M&A transaction. For example, if the seller’s existing financing arrangements are to be assumed by the purchaser, the purchaser may need to negotiate with the seller’s financing parties.

On the other hand, the purchaser can explore other loan facilities with proper guidance by advisors/consultants.

Time Schedule

An M&A transaction involves a number of recognizable stages. Most of the stages may have more or less prominence depending on the way a particular deal is structured, the relationship of the parties, the financial position of the seller or any number of external factors.

From a seller’s viewpoint, the following standout:

- Retaining advisors and consultants: This requires the retention of Legal, financial, environmental, engineering/structural and/or valuation experts.

- Offering the target company for sale: This may possibly include steps such as soliciting bids, drafting and circulating a confidential information memorandum, as well as creating a data room to allow prospective purchasers to carry out due diligence.

- Negotiating the deal: This includes ensuring that certain basic terms are fixed at the time of accepting a particular bid, afterwards, fleshing this out in a letter of intent or term sheet, and then finally documenting the agreed upon terms in great detail in a definitive purchase agreement.

- Announcement: This gives the parties the opportunity to learn what the market thinks of their deal and to whether their shareholders are likely to approve the deal. It also gives the seller the opportunity to manage employee expectations.

- Shareholder approval: This must be obtained either by way of the purchaser making a take-over bid which shareholders may accept or reject, or the target business holding a shareholder meeting at which shareholders vote upon the transaction. Depending on applicable stock exchange rules (where the purchaser is a listed company), if the purchaser is issuing shares as part of the purchase consideration, the purchaser may also need its shareholders to approve the deal. In all cases, a disclosure document, either a proxy circular for a shareholder meeting, or a take-over bid circular or directors’ circular, must be prepared and sent to the relevant shareholders.

- Regulatory approvals: Regulatory approval applications are usually commenced following the announcement, while the applicable shareholder approval process is underway.

- Third party consents/financing: Also at the same time, third party consents and financing arrangements, if necessary, are secured.

- Closing: Once the above are in place, the transaction closes and the purchase price can be paid.

Conclusion

As noted at the beginning, M&A transactions can be complex and the timeline for a transaction is dependent on so many factors as outlined above and even more. A proper consultation with the relevant advisors will ensure that the deal is cost and time effiecient.

Written by Chinedu Aralu LLM (Aberdeen)